It’s been 4 years since the United Kingdom made its subsequent decision to withdraw from the European Union. During this time, change has occurred slowly as and when the new terms trickle in. The hard work is far from over, however, and the UK and the EU still have many deep and comprehensive agreements to settle. Which way will they sway? At this point, there’s still much uncertainty.

What we do know is that if a final agreement is not made by the end of 2020, then the UK’s withdrawal from the EU will mean that banking institutions will forfeit their free access to the single European market altogether.

For now, employees in the financial sector, global mobility managers, and even those who provide temporary housing may already be feeling the impact of Brexit. The question is, why?

The Loss of Passporting Rights

According to Reuters, BNP Paribas (the most prominent European bank in the UK) will have to leave London ground whenever dealing with European clients. Europe’s HSBC will also be forced to relocate many of its branches to Paris (1000 HSBC employees have already moved). J.P. Morgan has also relocated there.

Many other British and European banks are following this trend, and not because the corporates want a change of scenery. It all comes down to the loss of passporting rights.

What is this “passport” we’re referring to?

Essentially, this EU passport allows financial institutions in the United Kingdom to sell their services to all EU countries. So, for example, a London-based bank can do a straightforward sale to a company based in, say, Madrid. In essence, with this passport, there is no regulatory barriers.

This freedom forms the crux of single market in financial services.

At this point, it is important to note that it’s not just UK banks that have this freedom that comes with passporting rights, but also foreign financial firms that have established branches in the United Kingdom. Take an American bank with a Dublin-based branch as an example. With access to this financial passport, this bank can sell services right across the European Union as if it were a European financial services company itself.

So, what’s happening now that the UK is losing full access to passporting rights?

Financial service providers that once had the right to sell to any EU company will no longer be able to operate these services out of the UK. And that’s why banks such as BNP Paribas Paris and HSBC are rushing to establish subsidiaries within the EU while they apply for a local licence.

Relocation to Continental Europe

With the loss of passporting rights, 2018 through to 2020 has seen an increase in the number of companies relocating and establishing new headquarters away from their homeland. These companies are not limited to the financial sector. Corporate giants such as Ford, Goldman Sachs (who recently confirmed the shift of its London headquarter to Paris), and even Panasonic (who will be moving its European headquarters from London to Amsterdam to avoid potential tax issues) are making similar strategic moves. [1]

So, what does this mean? It means that corporate relocation to continental Europe will be on the rise and over the next few months and years, many employees may have to move to secure their careers. This means that Europe and the UK could be playing “musical chairs” until stability and effective terms of trade have been established.

Suffice it to say, global mobility managers and temporary housing providers are feeling the pressure as the need for relocation gets more heated.

New Office Openings in the UK

Referencing regulatory consultancy Bovill – “more than a thousand banks, asset managers, payments companies and insurers in the European Union plan to open offices in post-Brexit Britain so they can continue serving UK clients”[2]

This is good news for the UK because the new offices and employees will help make up for the loss of business going the other way. As it stands, London (still regarded as one of Europe’s premier financial services hubs), is preparing to accommodate corporate expatriates from the likes of Germany, France, the Netherlands and other EU countries.

But what does this mean? It means that the job market for those who work in finance may change slightly. For example, Ernst & Young, one of London’s largest professional services providers, maintains that an estimated 7,000 positions would be relocated from London to the continent and then 2,400 new positions will be created in local EU branches [2]. This essentially means that European firms will be buying relocation services, temporary accommodation, office space, hiring staff, and engaging legal and professional advisers within the United Kingdom.

It means that the job market for those who work in finance may change slightly. For example, Ernst & Young, one of London’s largest professional services providers, maintains that an estimated 7,000 positions would be relocated from London to the continent and then 2,400 new positions will be created in local EU branches [2]. This essentially means that European firms will be buying relocation services, temporary accommodation, office space, hiring staff, and engaging legal and professional advisers within the United Kingdom.

Once again – this could play in the favour of global mobility managers and temporary housing providers as the EU and the UK financial service providers reorganise their processes and set-up their new firms.

Brexit’s impact on Fintech

Last, but not least, there’s the impact that Brexit will have on fintech (financial technology). Many fintech companies chose London because of the city’s robust financial regulation, but how will London’s parting from the EU affect the industry?

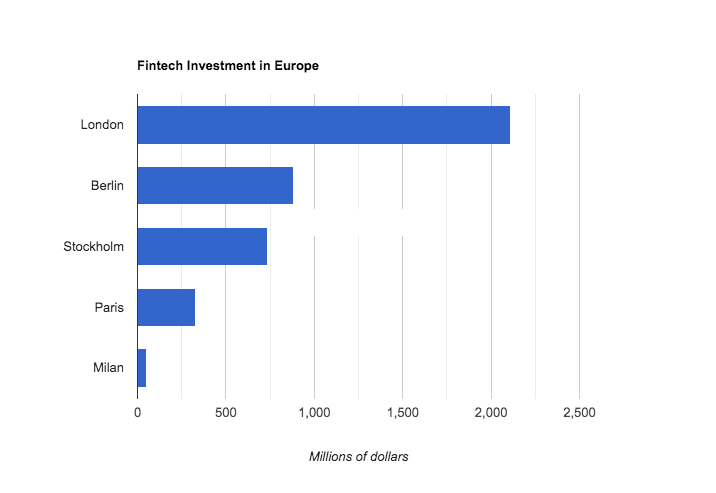

Did you know that as of September 2019, London led the overall fintech investment in Europe at $2.11bn? It was followed by Berlin ($881m), Stockholm ($734m), Paris ($330m) and Milan ($49m). [3]

But with Brexit in full swing, the entire United Kingdom will lose access to their pool of EU applicants, forcing many prominent fintechs to either relocate their businesses or open a new branch in the EU. This doesn’t sound like such a bad idea – except that it will increase operational and administrative expenses. As a result, UK fintechs will possibly opt to expand their operations to the US instead. Revolut’s banking chief executive Richard Davies recently announced that the popular fintech company will be opening offices in Dublin, Ireland in order to serve Western Europe as well as in Vilnius, Lithuania for Central and Eastern Europe customers. Unlike Revolut, who will keep its UK presence, the Berlin headquartered neo-bank N26 ceased its UK operations from April 2020. It has resulted in closing over 200,000 customer accounts and relocation of its workforce towards the continent.

While it is too early to have a full understanding of Brexit’s impact on fintech, it’s a definite that the industry will witness slow but steady changes over the next few months.

Now, only time will tell what the full impact will be.

AltoVita provides curated temporary housing accommodations, compliant to duty of care and health & safety standards, suitable for corporate relocation and short term assignments. Learn more about how to save on accommodation costs & enhance employee experience during corporate transfers through our Enterprise Solutions and read more about our 3-Tier Supply Quality Control here.

References:

[1] Reuters. Impact on banks from Britain’s vote to leave the EU

[2] Reuters. A thousand EU financial firms plan to open UK offices after Brexit

Sources:

The Independent UK. Which companies are leaving UK, downsizing or cutting jobs ahead of Brexit?

EY. How Brexit will impact financial services mobility and relocation.

Penser. Brexit and Fintech: What Can We Expect?

Bleisure Travel Explained: Meaning, Benefits & Business Impact

Next Article