It’s no surprise to learn that serviced apartments have emerged as one of the most rapidly expanding real estate asset classes within the UK. What may be surprising to hear, however, is that progress on recording collective data related to this sector, and its representation compared to hotels, hasn’t kept up pace.

That’s according to a new report from the Association of Serviced Apartment Providers (ASAP), a not-for-profit trade body representing serviced accommodation providers that collectively operate 100,000 apartments in 21 countries, and offer over 3 million bed nights per year.

Now, in this first-of-its-kind study, ASAP has decided to counter the lack of data with a deep dive into the sectors’s market dynamics, customer profiles and substantial role in both the UK economy and local communities.

Its release follows the UK government’s consultation on short-term lets regulation. ASAP intends for this report to provide policymakers with a comprehensive view to guide regulatory decisions.

Here’s a snapshot of the report:

The State of the UK Market: In Numbers

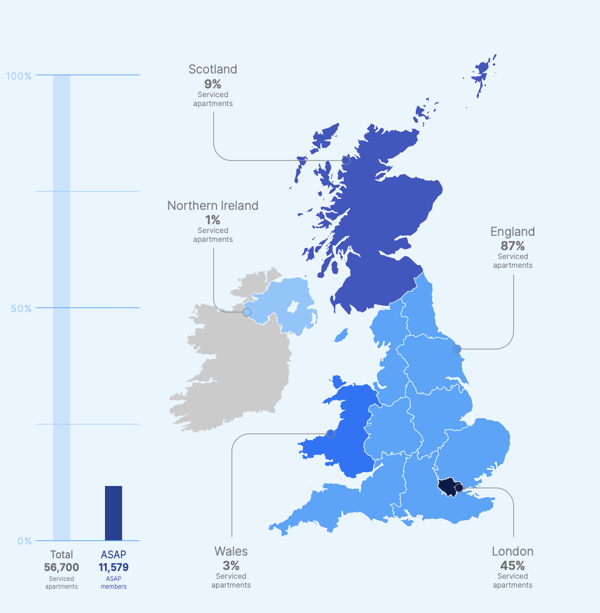

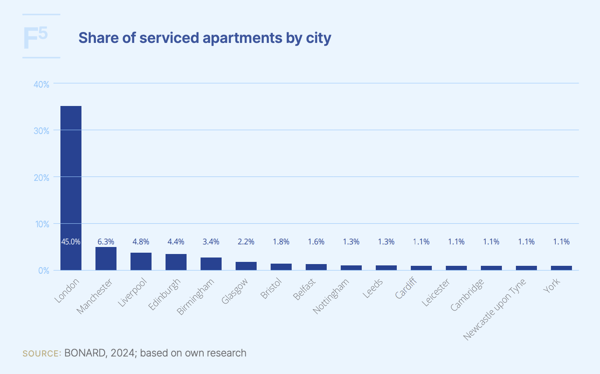

According to the report, there are 56,700 serviced apartments spread across the UK. Among them, 28,566 properties across more than 1,400 buildings are managed under a brand, meaning they are operated by a company rather than a private host. ASAP said that its members account for 41% of these establishments.

The rest of the market is particularly fragmented and comprises a long tail of independent operators and "singlekey" offers on the market (approximately 28,000 apartments).

Major Employment Provider

It’s estimated that in the UK, serviced apartments directly support a minimum of 6,050 jobs. That’s based on ASAP members employing 2,460 people (1,927 full-time and 533 part-time employees).

England Dominates

England accounts for 87% of all serviced apartments in the UK, followed by Scotland (9%). At 3% and 1%, respectively, Wales and Northern Ireland are yet to develop a more sizeable supply, ASAP states.

Who’s Checking In?

Business travellers comprise the largest share of guests (45%), followed by tourists (27%), and professionals relocating to the UK (23%). Importantly, the sector caters to both domestic and international guests (59% to 41% ratio). The average length of stay in 2022 was 3 days; however, 11% of customers stayed between 30 and 89 days and 6% stayed longer than 90 days.

Services & Amenities

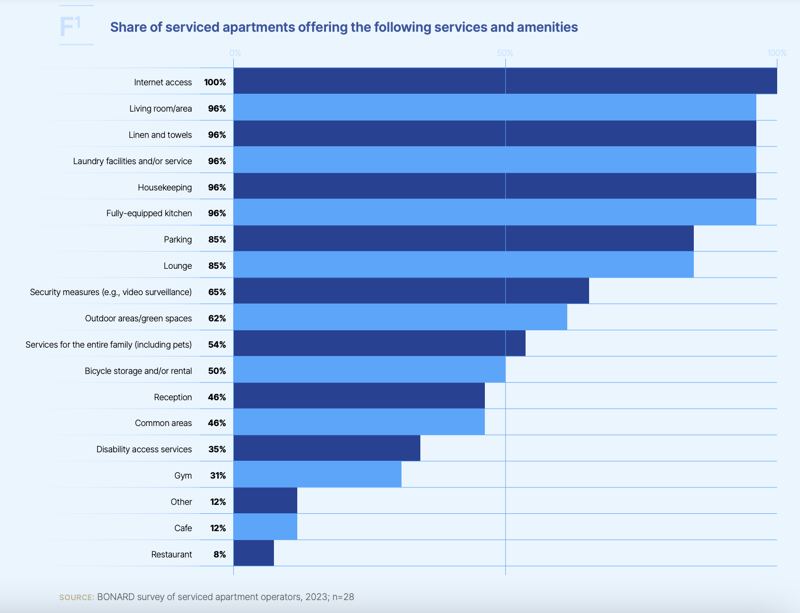

ASAP's report provides a comprehensive rundown of what exactly is being offered.

In addition to internet connectivity (at 100%), the vast majority of providers offer private kitchens or kitchenettes, housekeeping services, laundry facilities, and separate relaxation and work spaces. Compared to traditional hotels, serviced apartments typically provide more spacious rooms and additional living areas.

Parking and a lounge are common features offered by 85% of providers, while security measures, implemented by 65% of providers, contribute to a safer environment.

Six in ten providers offer outdoor areas or green spaces, and common areas are available in 46% of properties, while gyms are less prevalent at 31%.

A £1.7 Billion Economic Impact

Figures are only available for 2022, but the study found that serviced apartments generated £1.2 billion in turnover. However, ASAP notes this is a conservative estimate, as it’s based on existing supply data and financial information acquired via the provider survey (providers were queried about their turnover, which was extrapolated over the entire market).

Considering the whole market including independent operators, ASAP calculates the sector actually generates £1.7 billion per annum in turnover.

The Next Steps

As mentioned, the report follows the UK government’s consultation on short-term lets regulation. ASAP's research also gathered feedback on serviced apartment operators’ views on approaches to enhance sector governance.

Respondents highlighted the need for regulations that would: establish solid sector-wide standards and entry barriers, making it impossible for non-professional providers to operate; enhance safety and security standards, including requirements for fire and general risk assessments, smoke alarms, health and safety measures, liability insurance, and water safety protocols; foster improved communication between the sector and local and national government bodies, while also raising public awareness about the sector’s significance in addressing housing shortages.

ASAP has proposed a three-stage approach to help ensure that the regulation meets it intended purpose:

Launch a National and Mandatory Light-Touch Scheme

A visible registration number for display would provide essential assurances and accountability. This scheme should prioritise minimum health and safety standards, be affordable (with a scalable fee based on the number of apartments under management), and drive standards by helping to eliminate noncompliant businesses from the market.

Data Collection and Evaluation

Collecting and evaluating data from registered providers would help inform local councils, ASAP argues, defining key provider categories, and establishing parameters for effective supply management.

Establish a Platform for Ongoing Sector Consultations

ASAP also wants to see a joint working group comprising sector representatives, along with government or local council representatives, established. This group can identify potential loopholes and promote systems for driving good practice (including taxation compliance and adherence to health and safety regulations.

The report presents findings from research carried out from July to December 2023. ASAP commissioned BONARD, a research and advisory firm specialising in global rental asset classes, for the independent study, with assistance from many operator and agency project sponsors (including AltoVita).

You can download “An Independent Review of the Role and Value of Serviced Apartments in the UK” on the ASAP website.

Previous Article